Tax Calculator

Use this calculator to estimate the taxes

you owe based on your taxable income.

Taxable Income

Enter the taxable income amount from line 260 of your personal income tax return.

Enter the taxable income amount from line 260 of your personal income tax return.

Contribution Amount

Enter 3 RRSP contribution amounts to compare the tax savings and after-tax amount for each contribution.

Enter 3 RRSP contribution amounts to compare the tax savings and after-tax amount for each contribution.

| Taxes Payable: | $10,950 |

| Net Income: | $44,050 |

| Taxable Income: | $55,000 |

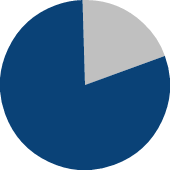

| Avg Tax Rate | Marginal Tax Rates |

Avg Tax

Rate

Rate

Interest/

Salary

Salary

Capital

Gains

Gains

Eligible

Dividends

Dividends

Assumptions

Calculations use marginal tax rates as of January 2019. Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The Average Tax Rate is calculated by dividing the Taxes Payable amount by the Taxable Income amount.

Disclaimer

This calculator is for educational purposes only. All charts and illustrations are for illustrative purposes only and are not intended to illustrate the performance of any security or portfolio. You should not rely on the results as an indication of your financial needs and we recommend that you seek your own financial, investment, tax, legal or accounting advice nor shall the information herein be considered as investment advice or as a recommendation to enter into any transaction. Professional advice should be obtained prior to acting on the basis of this information. The deduction of advisory fees, brokerage or other commissions and any other expenses that would have been paid may not be reflected in the calculation results. ® CI Investments and the CI Investments design are registered trademarks of CI Investments Inc.

Calculations use marginal tax rates as of January 2019. Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The Average Tax Rate is calculated by dividing the Taxes Payable amount by the Taxable Income amount.

Disclaimer

This calculator is for educational purposes only. All charts and illustrations are for illustrative purposes only and are not intended to illustrate the performance of any security or portfolio. You should not rely on the results as an indication of your financial needs and we recommend that you seek your own financial, investment, tax, legal or accounting advice nor shall the information herein be considered as investment advice or as a recommendation to enter into any transaction. Professional advice should be obtained prior to acting on the basis of this information. The deduction of advisory fees, brokerage or other commissions and any other expenses that would have been paid may not be reflected in the calculation results. ® CI Investments and the CI Investments design are registered trademarks of CI Investments Inc.

CI Investments and the CI Investments design are registered trademarks of CI Investments Inc.

CI Investments and the CI Investments design are registered trademarks of CI Investments Inc.