Rate of Return Odds

See how different portfolios and holding periods affect the odds of reaching a target rate of return.

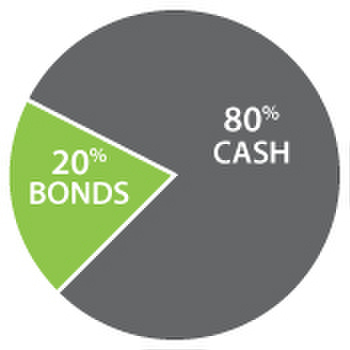

Moderate Portfolio

|

Distribution of Annual Rates of Return

1 Year Holding Periods

1 Year Holding Periods

Negative

Returns

Returns

0% to

4.99%

4.99%

5% to

7.99%

7.99%

8% to

9.99%

9.99%

10% to

11.99%

11.99%

12% to

14.99%

14.99%

15% to

19.99%

19.99%

20% &

over

over

Assumptions

Best, worst and average returns are annual compound rates of return for various holding periods and portfolio combinations from 1947 to 2021 inclusive. Portfolios were rebalanced to their original allocation every twelve months. Stocks are represented by the S&P/TSX Total Return Index, bonds by the Canada 10 Year Total Return Government Bond Index and cash by the Canada Total Returns TBill Index.

Disclaimer

Best, worst and average returns are annual compound rates of return for various holding periods and portfolio combinations from 1947 to 2021 inclusive. Portfolios were rebalanced to their original allocation every twelve months. Stocks are represented by the S&P/TSX Total Return Index, bonds by the Canada 10 Year Total Return Government Bond Index and cash by the Canada Total Returns TBill Index.

Disclaimer