| Alberta |

|

100,000

|

Marginal tax rate

32.00%

Results

| Taxes Payable: | $10,950 |

| Net Income: | $44,050 |

| Taxable Income: | $55,000 |

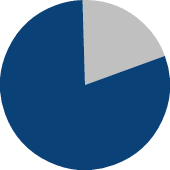

| Avg Tax Rate | Marginal Tax Rates |

Avg Tax

Rate

Rate

Interest/

Salary

Salary

Capital

Gains

Gains

Eligible

Dividends

Dividends

Assumptions

Calculations use marginal tax rates as of January 2019. Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The Average Tax Rate is calculated by dividing the Taxes Payable amount by the Taxable Income amount.

Disclaimer

Calculations use marginal tax rates as of January 2019. Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The Average Tax Rate is calculated by dividing the Taxes Payable amount by the Taxable Income amount.

Disclaimer